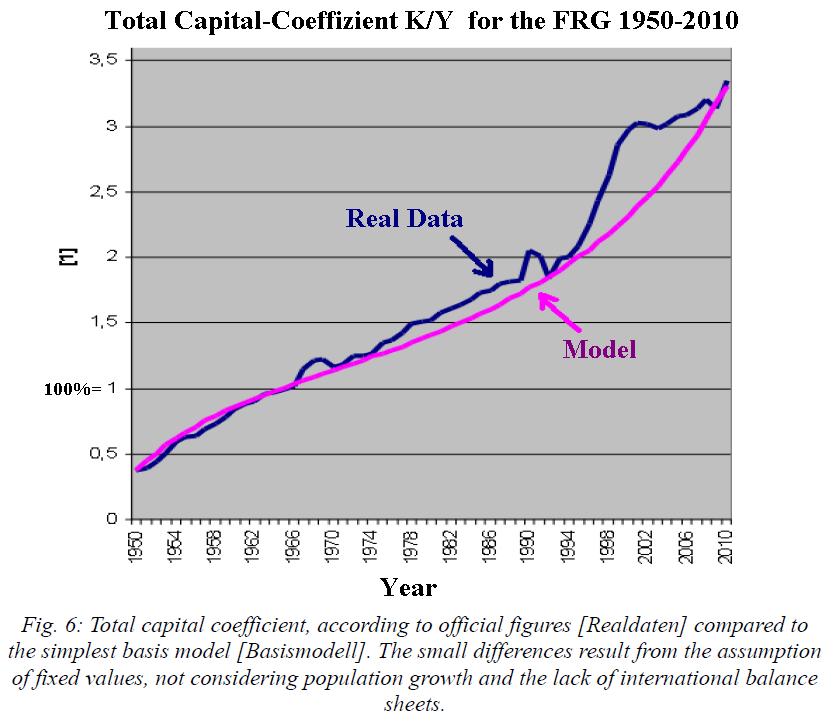

10 Capital Coefficients in the Model and Reality

The integrated values of Y and K, as well as the real values can be summarized conveniently in the total capital coefficient K/Y (fig. 6). Because the economic effectiveness is always given by this, as inflation is always shortened out due to the fact that both GDP and the capital stock are measured in units of currency. Currency is purely nominal, and the value of the currency is not determined by the nominal, but by what one could buy22 with it.

But what we have not considered in the basis model in detail, is the impact of inflation on the nominal monetary expression of Y and K in units of currency. In the model, we always compute Y and K in units of points, we always start with

![]() (10.1)

(10.1)

and by the initial value![]() , which can be

extracted from the real numbers determined of the Federal Republic

in 1950, and was indeed

, which can be

extracted from the real numbers determined of the Federal Republic

in 1950, and was indeed

![]() (10.2).

(10.2).

Currency points and currency units differ only

by a conversion factor. The inflation would be without inflation (![]() ) be constant

over time. But since we always have inflation, and as we will see later, this

is an intrinsic symmetry principle and predictable effect of the economy, this

conversion factor is variable in time. Inflation is no interest in the proper

sense because it has on capital and GDP, which are measured both in units of

capital (currency), exactly the same effect. So inflation creates no relative

gain or loss. This only makes

) be constant

over time. But since we always have inflation, and as we will see later, this

is an intrinsic symmetry principle and predictable effect of the economy, this

conversion factor is variable in time. Inflation is no interest in the proper

sense because it has on capital and GDP, which are measured both in units of

capital (currency), exactly the same effect. So inflation creates no relative

gain or loss. This only makes ![]() .

Therefore, the currency values of the individual functions Y and K

need a correction factor which includes the effect of inflation23. How to make these handy conversion

will be explained now. In the illustration of the basic model calculation is

has already been carried out in a linear fashion, so that instead of points the

solution appears in units of the currency Euro. If one wants to calculate an inflation

adjustment from the official empirical data one needs to bear in mind however,

that these offical values are calculated by a variety of different specific

group of buyers and their temporally variable commodity baskets, and thus are

only approximately calculated. From the 1980s, this statistical figure is also

increasingly bent by hedonic methods24. The

time-varying baskets

.

Therefore, the currency values of the individual functions Y and K

need a correction factor which includes the effect of inflation23. How to make these handy conversion

will be explained now. In the illustration of the basic model calculation is

has already been carried out in a linear fashion, so that instead of points the

solution appears in units of the currency Euro. If one wants to calculate an inflation

adjustment from the official empirical data one needs to bear in mind however,

that these offical values are calculated by a variety of different specific

group of buyers and their temporally variable commodity baskets, and thus are

only approximately calculated. From the 1980s, this statistical figure is also

increasingly bent by hedonic methods24. The

time-varying baskets ![]() can be described mathematically as

can be described mathematically as

![]() (10.3).

(10.3).

That means the price of the i-th

commodity basket of shopping for the consumer group i (eg average income

people, entrepreneurs, industries, etc.) is the weighted product price from the

sum over all products j. Their proportions![]() however, vary according to consumer group, between 0 and 1. In addition

there is a factor

however, vary according to consumer group, between 0 and 1. In addition

there is a factor ![]() from hedonic method. This means that assumed product

quality improvements will be adopted with a “better” price

from hedonic method. This means that assumed product

quality improvements will be adopted with a “better” price ![]() in effect reducing inflation. All factors are variable in time and the

choice is not given here by clear rules. The relevant for the consumer group i

calculated inflation rate is then the temporal change in the price of the i-th

commodity basket, so:

in effect reducing inflation. All factors are variable in time and the

choice is not given here by clear rules. The relevant for the consumer group i

calculated inflation rate is then the temporal change in the price of the i-th

commodity basket, so:

![]() (10.4).

(10.4).

The importance of the capital coefficient is so great because it establishes the proportion between in the principle value-free money to the valuable tradable goods and services. It is also free from the effects of inflation explained, because both the capital and the GDP calculated in units of capital and thus includes the only approximately known effect of inflation in exact the same way. The graphical representation of the total capital coefficient thus offers the easiest and fastest way of comparison between real economic data, both for the comparisons with other nations, and of course against the various model calculations.