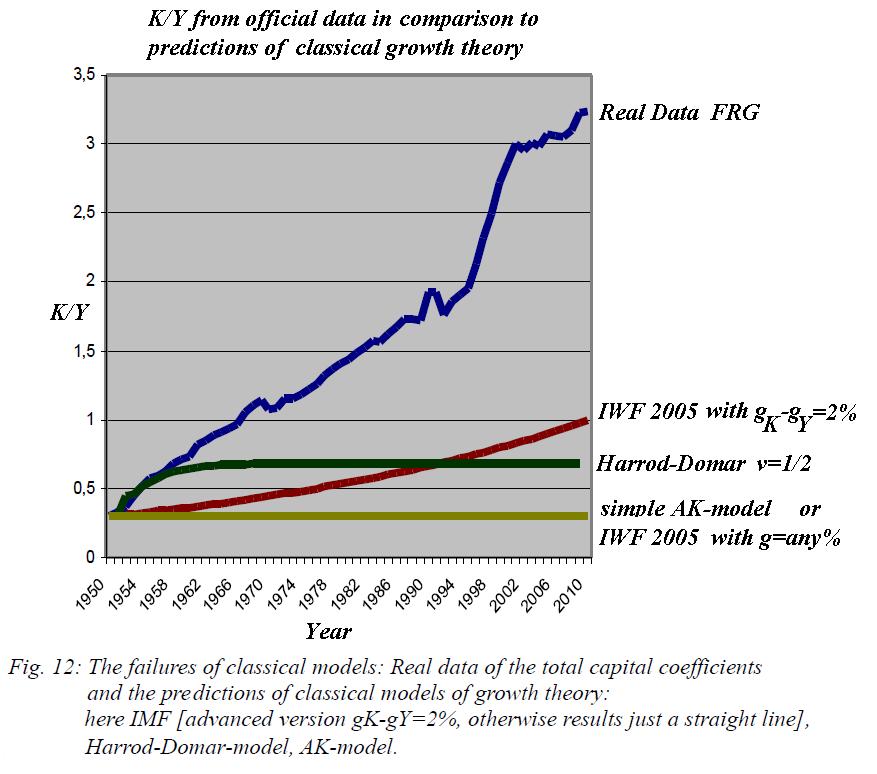

14 AK-Models and Others

The treated hereafter called AK-model is a model of endogenous growth theory, dating back to the economist Sergio Rebelo, and has the simplest possible approach:

![]() (14.1)

(14.1)

AK-models, however, are generally singular with

respect to the unknown functions Y and K, as they use to derive

the relationship between production and capital stock functions from only one

basic equation. So the approach can impossible lead to

a self-consistent solution of the problem. The production function![]() can be arbitrary

and thus be choosen to adapt to any presumption or

series of measurements. Therefore such models can only interpolate any

presumption or measurement to the future. It contains no reliable statement

about cause and effect (or sources and sinks). The IMFs

2005 model turns out to be but also an AK-model, because it can, as in (1.5) is

shown, by example with

can be arbitrary

and thus be choosen to adapt to any presumption or

series of measurements. Therefore such models can only interpolate any

presumption or measurement to the future. It contains no reliable statement

about cause and effect (or sources and sinks). The IMFs

2005 model turns out to be but also an AK-model, because it can, as in (1.5) is

shown, by example with ![]() or a similar

function been rephrased to an AK-model. This is an effect as can be shown, that

applies to every mathematically singular model. The same applies to the classic

post-Keynesian growth model of Harrod and Domar (Harrod, 1939, Domar 1946), because it is based on the approach

or a similar

function been rephrased to an AK-model. This is an effect as can be shown, that

applies to every mathematically singular model. The same applies to the classic

post-Keynesian growth model of Harrod and Domar (Harrod, 1939, Domar 1946), because it is based on the approach

![]() (14.2),

(14.2),

with the definition of![]() as capital productivity. This results trivially

in

as capital productivity. This results trivially

in![]() and thus is

likewise a typical AK-model with

and thus is

likewise a typical AK-model with ![]() and

has of course the same problem.

and

has of course the same problem.

Amazingly also the other known mathematical models of growth are AK-models. This results in many cases from using the so-called Cobb-Douglas production function (CDPF). Therefore in the next chapter we will deal with this very often involved function to estimate growth questions in classical macroeconomics.