19 Discussion of the Analytical Solution

The piece-wise solutions of Chapter 9 of the

simplest model equations give a lot of approaches for a comprehensive

discussion of the principle behavior of a credit-driven economy. First, we

compare the properly integrated piecewise solution to the IMF 2005 formula.

Exemplary of the GDP at the beginning of the development (![]() ) is:

) is:

![]() (19.1)

(19.1)

![]() (19.2)

(19.2)

We see that the singular IMF 2005 model (18.1) promises a constant growth rate g. The IMF model sets for g the general growth of the capital stock, but in truth, it is of course only the share of invested capital into the GDP. In fact (18.2), it is a combination of exponential and harmonic growth. The hyperbolic functions can be written as exponential function, because it holds

![]() (19.3).

(19.3).

For vanishingly small![]() holds

holds![]() and thus for the

small

and thus for the

small![]() also holds

also holds ![]() . We can

therefore write as an approximation for small arguments

. We can

therefore write as an approximation for small arguments![]() :

:

![]() (19.4)

(19.4)

The argument is

![]() (19.5).

(19.5).

and thus applies to the beginning of the development

![]() (19.6).

(19.6).

Hence we actually start early in the economy with approximately

![]() (19.7)

(19.7)

Analogously, this applies also for![]() , as is easily

verified. At the beginning there is an exponential slope not only of the

capital stock, but also of the GDP. However, not globally but only locally, and

also are there not the same values

, as is easily

verified. At the beginning there is an exponential slope not only of the

capital stock, but also of the GDP. However, not globally but only locally, and

also are there not the same values ![]() for

the slope rates, but

for

the slope rates, but![]() for the GDP and

for the GDP and![]() for the capital

stock. Since in the beginning almost all capital growth gains from direct

investment in GDP, also these values are initially very similar. No wonder then

that singular interpolating models may initially give the impression of a global

scope.

for the capital

stock. Since in the beginning almost all capital growth gains from direct

investment in GDP, also these values are initially very similar. No wonder then

that singular interpolating models may initially give the impression of a global

scope.

Over time, however, the terms![]() and

and![]() develop a very

different behavior as they change to

develop a very

different behavior as they change to![]() and

and![]() terms. Since they

are harmonic functions the argument

terms. Since they

are harmonic functions the argument![]() is

of particular importance. The argument of a time-dependent harmonic function

has the structure

is

of particular importance. The argument of a time-dependent harmonic function

has the structure![]() , with

, with![]() the so-called

angular frequency. There are the familiar relationships

the so-called

angular frequency. There are the familiar relationships![]() with

with![]() the frequency.

Wavelength

the frequency.

Wavelength![]() and frequency are

linked by the wave velocity

and frequency are

linked by the wave velocity![]() . The

characteristic time

. The

characteristic time![]() of course, is the

reciprocal of the frequency

of course, is the

reciprocal of the frequency![]() .So now we can

determine these values closer. The characteristic frequency is given by

.So now we can

determine these values closer. The characteristic frequency is given by

![]() (19.8)

(19.8)

and further, the characteristic time to

![]() (19.9).

(19.9).

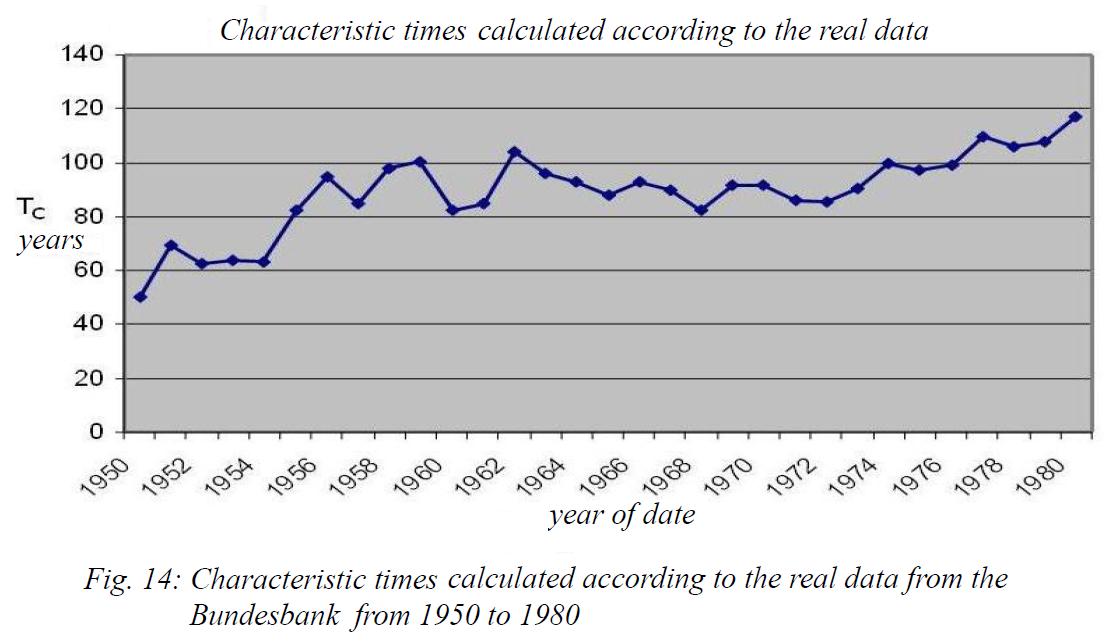

The time![]() can

be calculated if one uses the official figures of the statistics of the FRG. At

the beginning of development

can

be calculated if one uses the official figures of the statistics of the FRG. At

the beginning of development![]() was approximately

-17.9% and

was approximately

-17.9% and![]() about 4.2%. So it

follows immediately

about 4.2%. So it

follows immediately

![]() years (19.9)

years (19.9)

as the characteristic time. This characteristic

time is, in fact, be of the same magnitude as the critical time![]() , which we will

calculate in the next chapter of this book from a simple rule of thumb.

However, it has a slightly different meaning. The meaning of

, which we will

calculate in the next chapter of this book from a simple rule of thumb.

However, it has a slightly different meaning. The meaning of![]() is basically the

answer to the question: In which time it would be possible with the given

initial conditions, to increase GDP by a factor of

is basically the

answer to the question: In which time it would be possible with the given

initial conditions, to increase GDP by a factor of![]() ? With time-dependent increasing of the capital coefficient but this

gets always more difficult, and the characteristic time therefore gets larger.

? With time-dependent increasing of the capital coefficient but this

gets always more difficult, and the characteristic time therefore gets larger.

We can see

these characteristic values in the following figures, calculated according to

the official figures of the FRG: In the beginning the characteristic time![]() represents the

critical period

represents the

critical period![]() given by the compound

interest rule of thumb next chapter. For the range of initial conditions

given by the compound

interest rule of thumb next chapter. For the range of initial conditions![]() we get about

we get about ![]() years.

years.

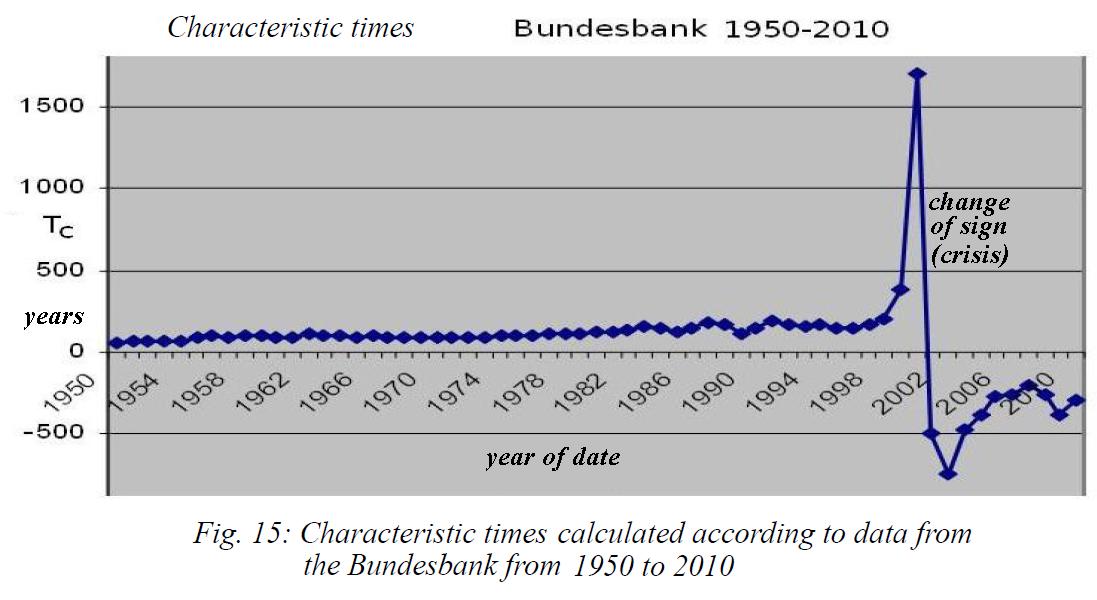

But after

that![]() grows strongly

and ultimately turns sharply to negative values. This inflection point is given

by the year 2000. For the growth path of the economy thus the parameter

grows strongly

and ultimately turns sharply to negative values. This inflection point is given

by the year 2000. For the growth path of the economy thus the parameter

![]()

is crucial. It must be kept negative to stay in

the growth-regime of the![]() and thus does not

enter into the realm of the down-sloping

and thus does not

enter into the realm of the down-sloping ![]() .

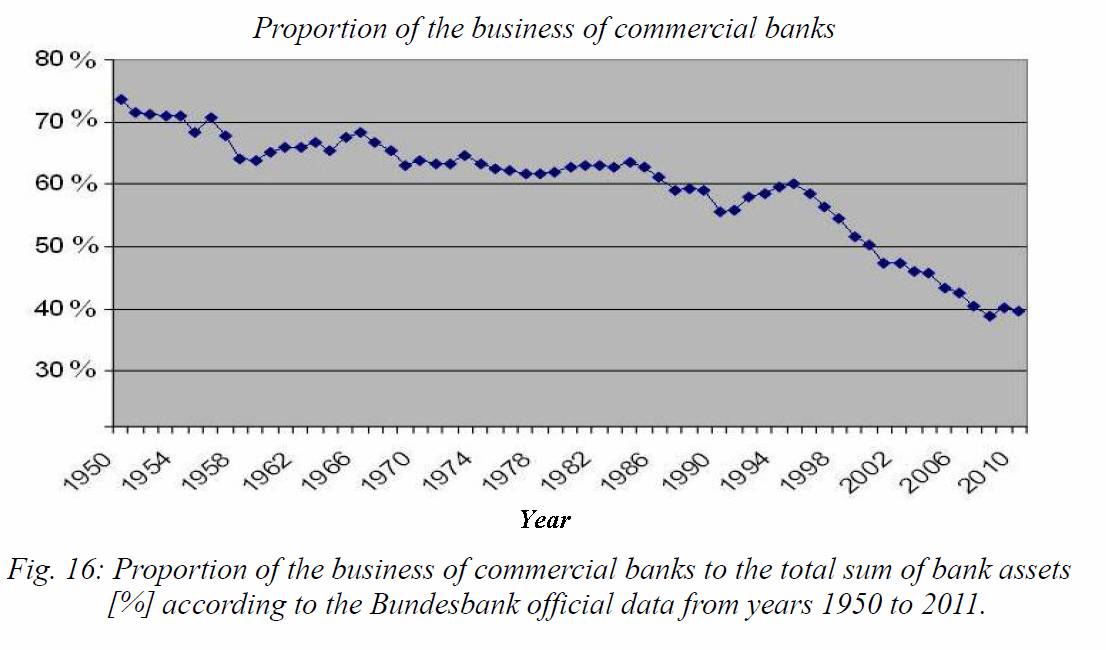

Since 2001, but this value is positive in the FRG. The share of domestic

lending business has declined since 1950 by almost 73% to less than 40%. To

assess the growth parameters we reflect again on the importance of individual

variables.

.

Since 2001, but this value is positive in the FRG. The share of domestic

lending business has declined since 1950 by almost 73% to less than 40%. To

assess the growth parameters we reflect again on the importance of individual

variables.

It is the condition

![]() (19.10)

(19.10)

to comply, which in turn gives the conditions

for![]() greater or less

zero:

greater or less

zero:

![]() :

:

![]() (19.11)

(19.11)

![]() :

:

![]() (19.12)

(19.12)

As we see it is in each of the four cases in

turn critical if the relative share of investment in the real economy![]() is larger or less

than 50%, which is the same as

is larger or less

than 50%, which is the same as![]() is greater than

or less than zero.

is greater than

or less than zero.

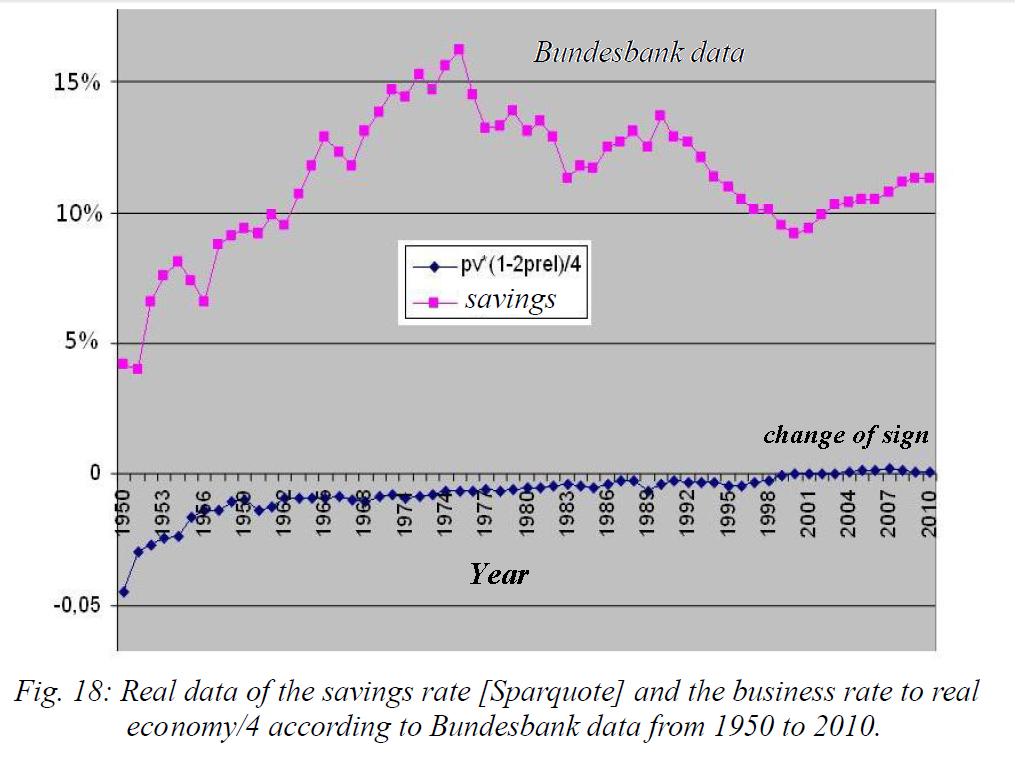

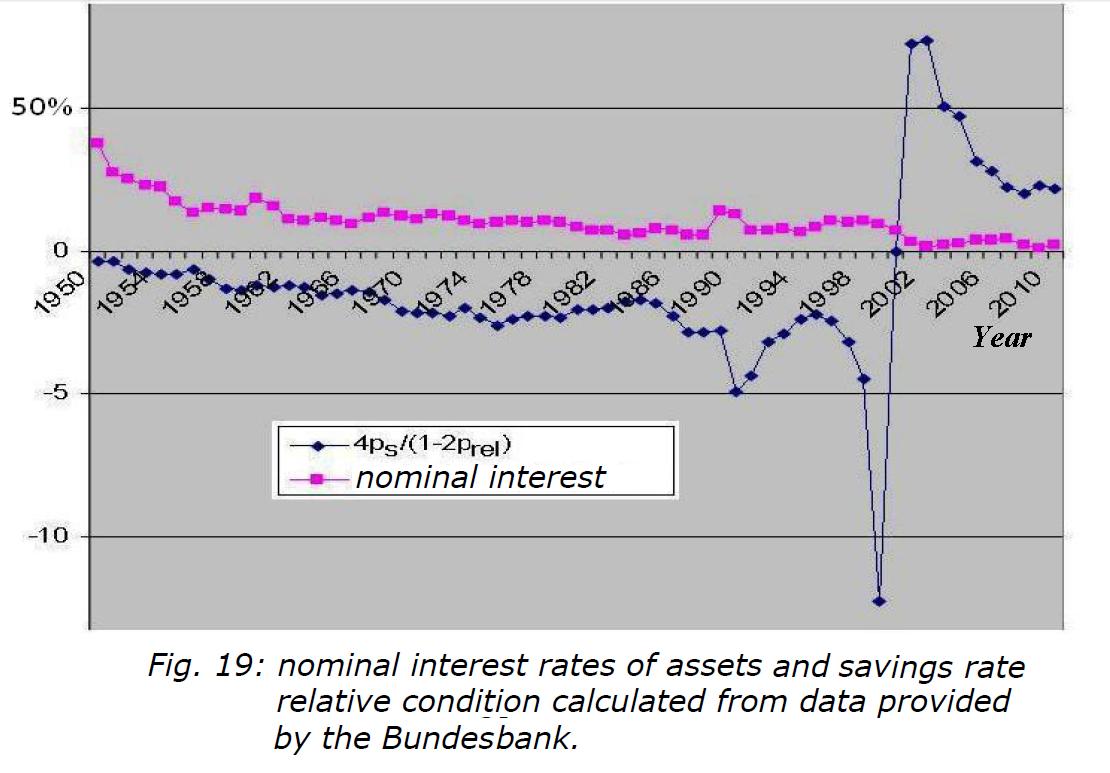

In the next

graph we can see, calculated according to official figures from the Bundesbank,

the growth frequency![]() (scaled40 by the factor 50) and the share of

real investment

(scaled40 by the factor 50) and the share of

real investment![]() (scaled by 4).

One can clearly see how the crisis situation since 2000 is associated with the

decline of real credit share below 50% and also the drop in growth rate below

zero.

(scaled by 4).

One can clearly see how the crisis situation since 2000 is associated with the

decline of real credit share below 50% and also the drop in growth rate below

zero.

Potential strategy for how you can still stay on a positive growth path, we must therefore continue to consider the four different cases F1 to F4:

![]() (F1)

(F1)

![]() (19.13)

(19.13)

![]() (F2)

(F2)

![]() (19.14)

(19.14)

![]() (F3)

(F3)

![]() (19.15)

(19.15)

![]() (F4)

(F4)

![]() (19.16)

(19.16)

Until 2000 the case F2 was present in

the FRG. We see here on the official figures, the FRG typical high savings

rate. The relevant limit value![]() is

maintained until the year 2000.

is

maintained until the year 2000.

Afterwards,

however, the value of![]() changes its sign,

because since then the value of the share of investment to the real economy

fell below 50%.

changes its sign,

because since then the value of the share of investment to the real economy

fell below 50%.

Thus, we switch to F1 case with the condition![]() for the growth

path. Currently

for the growth

path. Currently![]() is only about 40%

at a nominal interest rate of less than 2%, and thus

is only about 40%

at a nominal interest rate of less than 2%, and thus![]() would have to

apply. This means that the savings rate would have to be less than <0.1%,

thus best negative, in order to remain on a growth path. Alternatively, would

also be a negative nominal interest rate

would have to

apply. This means that the savings rate would have to be less than <0.1%,

thus best negative, in order to remain on a growth path. Alternatively, would

also be a negative nominal interest rate![]() of bank assets imaginable. One possibility would then be the case F3.

That would mean that with a high proportion of investment banking, with a

savings rate of

of bank assets imaginable. One possibility would then be the case F3.

That would mean that with a high proportion of investment banking, with a

savings rate of

![]() , e.g.

, e.g. ![]() ,

,

the growth condition would also continue to be

met with a positive savings rate.

Remains finally the case F4: So likewise, a negative nominal interest

rates![]() of assets, but at

reduced investment share, and a savings rate of condition of

of assets, but at

reduced investment share, and a savings rate of condition of

![]() , e.g.

, e.g.![]() .

.

The last example also shows the growth

condition, that meets the growth path only with negative savings rate. One can

clearly see the importance of the relative ratio of investment in the real

economy![]() in the next

graphic. Because of positive nominal interest rate always

in the next

graphic. Because of positive nominal interest rate always![]() is to demand.

is to demand.

The latter

value does, however, with the fall of![]() below

the 50% level, and thus the preponderance of bank equity business, a sign

change. So unattainable with the FRG typical high savings rate is above

condition. To return to growth path thus the possibilities are limited. The

result would call into question, to reduce the savings rate to well below zero.

below

the 50% level, and thus the preponderance of bank equity business, a sign

change. So unattainable with the FRG typical high savings rate is above

condition. To return to growth path thus the possibilities are limited. The

result would call into question, to reduce the savings rate to well below zero.