30 Remarks on the Role of Technology, Productivity and Education

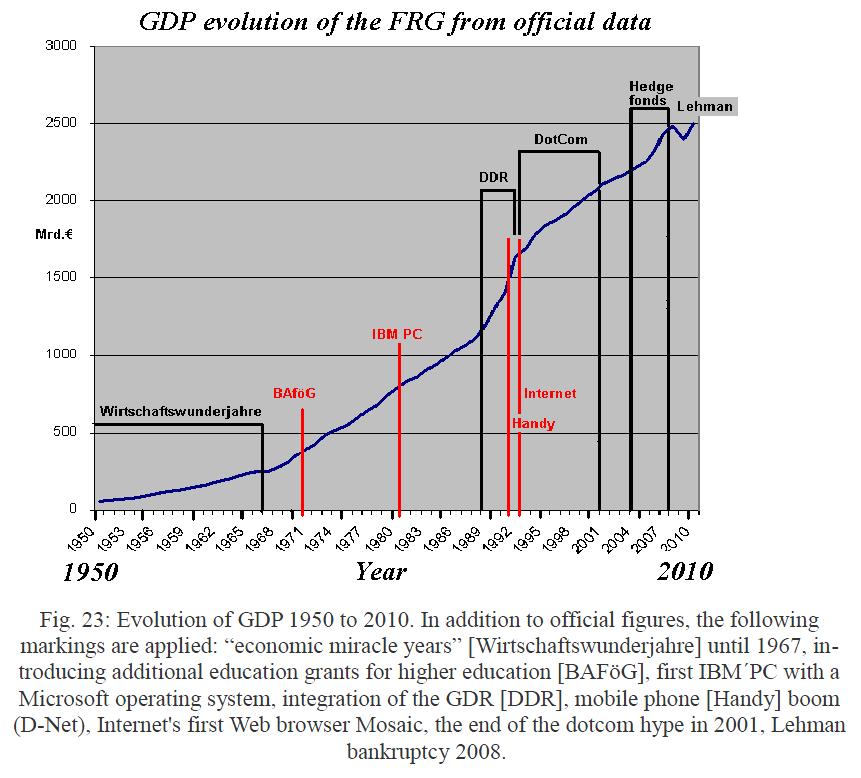

New products have to fight first for their part of GDP. This is for example well-known in the advertising industry, as a result of substitution economy. This fight is not abrupt, as with new and better products the therefore necessary additionally income is not generated automatically and at once. The classical growth theory expects, especially the already treated Cobb-Douglas production function, a noticeable jump62 in the GDP by innovations. But one unfortunately cannot see this to be evident in the real numbers. Let us consider the above figure, where are placed in the Federal Statistical Office calculated GDP figures over a number of important events. It is noticeable that GDP has, despite many technical and administrative innovation over time, rarely real jumps, but in general very continuously growing.

By contrast to common opinion, even the most important technical innovations did not induce any such jump. Nor did the PC, nor did it the mobile phone and not the internet too. On the contrary, they even flattened the slope of the GDP rather off. First in 2005, despite the lack of technology or large-scale educational innovations, we see a first real step. The reason might be sought in the tax reform begun in 2000 under Chancellor Schroeder which released additional funds for consumption. Of utmost importance is the Investment Modernization Act in force since 2004, but which allowed for the first time in the FRG so-called hedge funds.

With that an increasing job cut at the companies in the FRG took place in connection with the accompanying increase in the purchase and sale of all businesses and companies. This led to a significantly improved short-term revenue side of the business, but on the other side to a worsening decline of the demand to real and financial products. Especially since the large base component of consumption, the good earning middle class, has been disproportionately affected. A little later the Lehman bankruptcy in 2008 led to a worldwide slump in the financial and economic markets too.

Jumps in the GDP will only be possible if an increase in the money supply, in particular the wages of consumers, is associated. This is automatically and quickly rarest the case, but a medium-term effect of supply and demand for the product Labor, which of course is also a part of the full quantity equation. Since modern technology, so most of the PC and the Internet, however, made an increase in productivity without a boost in demand for the product Labor, this fizzled out obviously the effect of this so very sustainable technology innovations in the overall balance of the GDP's.

Due to the general substitution effect innovations are indeed no guarantee of an increase in the GDP's. But they are, just like the improvement of "human capital" through education, of course an indispensable condition for the competition between the economies to remain "tuned". Whether an economy grows more by agriculture or is able to grow by technology products, that is less obvious from the product, as from the availability of capital on the one hand and enough consumers of products on the other hand.

Productivity can be increased e.g. by advances in technology and/or in the education of the working people. To introduce the role of productivity into the equations, one can do this with an approximate or an exact ansatz. The approximate ansatz was first introduced by Bürkler and Besci [Besci, 2012] and does the following:

![]() (30.1)

(30.1)

where![]() is

the function of effective(!) productivity increase (decrease) which has to be

modeled by e.g. using statistical data. This phenomenological ansatz will work,

as the measured effective productivity increase/decrease is incorporated. But

it will give no distinct answers to the question, how productivity works

economical, e.g. in which way investments into productivity increase are

effective for the supply of assets, labor and wages and at last to the GDP. To

address such questions, one has to consider the retroactivity between

investments into technology or education on the one side, and the

substitutional effects with other products on the other side.

is

the function of effective(!) productivity increase (decrease) which has to be

modeled by e.g. using statistical data. This phenomenological ansatz will work,

as the measured effective productivity increase/decrease is incorporated. But

it will give no distinct answers to the question, how productivity works

economical, e.g. in which way investments into productivity increase are

effective for the supply of assets, labor and wages and at last to the GDP. To

address such questions, one has to consider the retroactivity between

investments into technology or education on the one side, and the

substitutional effects with other products on the other side.

This can only be done by constituting more dependent differential equations into the system. This will be addressed in the second part of the book (general theory). Introducing further parts, e.g. like labor L and wages, investments to real economy I, investments into technology T, investments into education E and so on will give further interdependent differential equations, e.g. the very complex system dY=f1(Y,L,I,K,E,T); dL=f2(Y,L,I,K,E,T); dI=f3(Y,L,I,K,E,T); dE=f4(Y,L,I,K,E,T); dT=f5(Y,L,I,K,E,T); dK=f6(Y,L,I,K,E,T).