33 Short Remark on the Economic Cycle

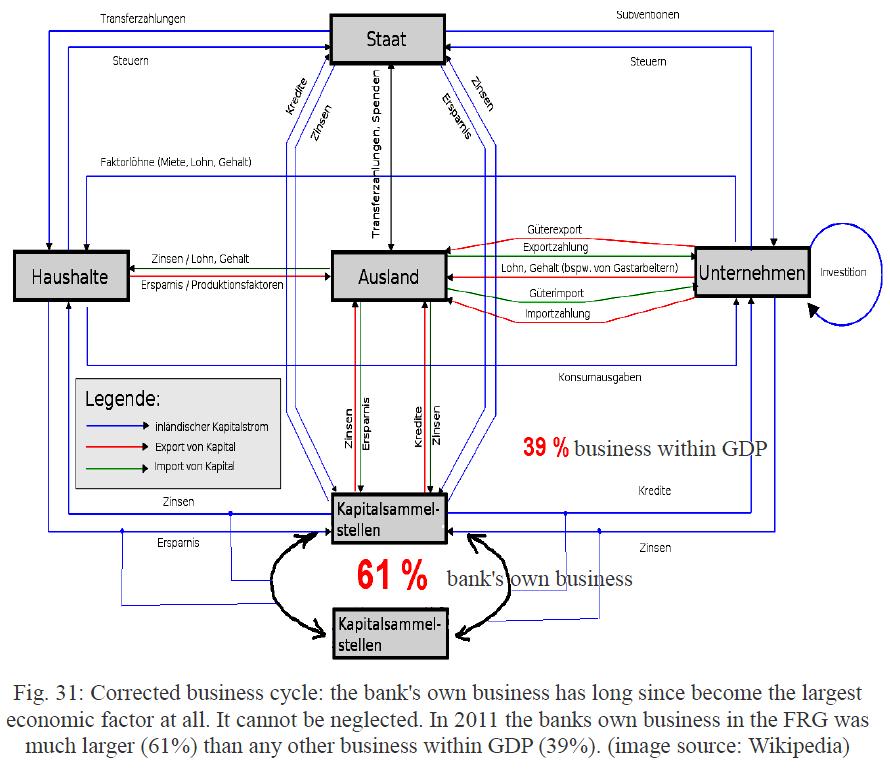

Capital stock in classical economics usually is equated with the use of capital in the real economy, especially so with their lending to domestic non-banks. The result is that in the classical business cycle, the bank's own business is virtually nonexistent.

The implicit assumption behind it is, that the bank's own business should play no macroeconomic role because of a lack of credit or expenses to the real economy. But this widespread opinion is, however, tantamount to the assertion that todays now largest by its volume of all economic operators is no economic operator at all.

For the state, as one of the largest commercial operator in the FRG has a state quota of about 1000 billion per year. That's less than half of the GDP. The investment banking business but is more than two GDP's in the FRG, and its turnover by this is by four times as large as the state itself. In fact, the economic cycle in the graph Fig. 31 is to be expanded by the substantial proportion of banks own business that engages necessarily the same in the flow of interest, loans and savings, as well as all other economic operators do.

For the state, as one of the largest commercial operator in the FRG has a state quota of about 1000 billion per year. That's less than half of the GDP. The investment banking business but is more than two GDP's in the FRG, and its turnover by this is by four times as large as the state itself. In fact, the economic cycle in the graph Fig. 31 is to be expanded by the substantial proportion of banks own business that engages necessarily the same in the flow of interest, loans and savings, as well as all other economic operators do. Indeed besides the mathematical shortcuts of classical growth theory, neglecting banks own business (which is today the largest amount which adds to the loans up to the total capitalstock of an economy) and its unavoidable back-reaction to GDP, is the second large failure of classical growth theory.