43 The Predator-Prey Symmetry

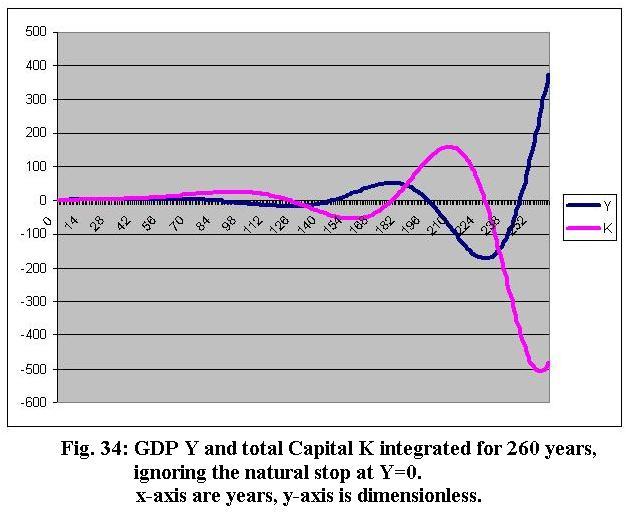

Real solution will break the latest, when the

GDP has fallen to zero. To examine the formal structure of the linear system of

equations, we but can simply continue to run the equations beyond the endpoint![]() . In the

following figure, we see the resulting effect: The

solutions for K and Y will oscillate somehow out of phase around

the zero line. It does, however, increase the maximum amplitude in time

exponentially.

. In the

following figure, we see the resulting effect: The

solutions for K and Y will oscillate somehow out of phase around

the zero line. It does, however, increase the maximum amplitude in time

exponentially.

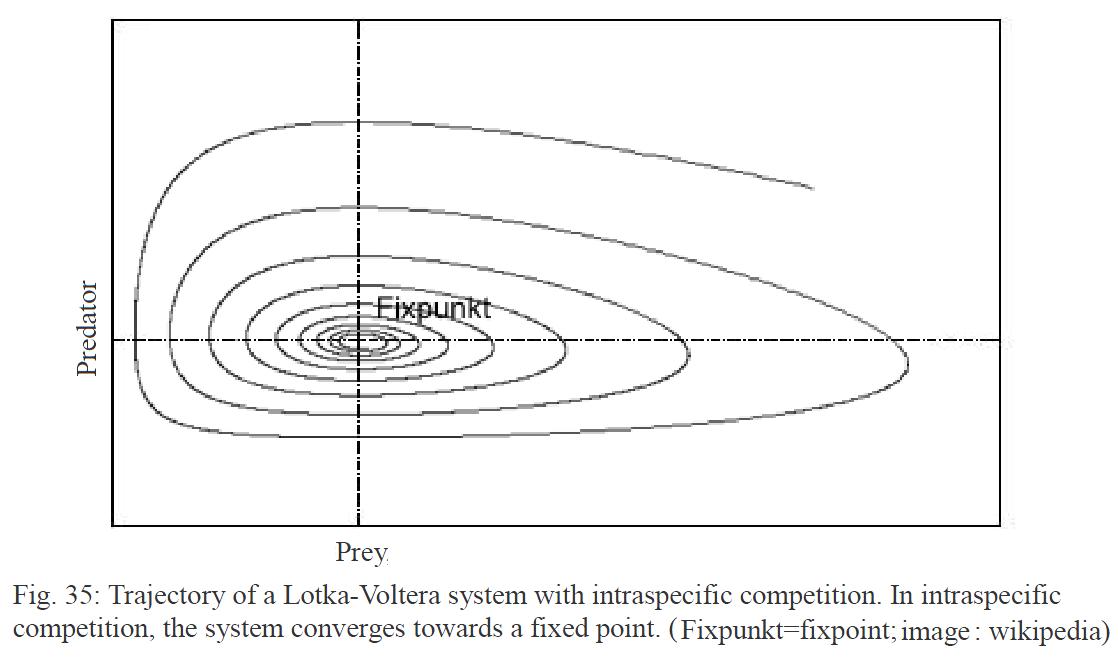

Such solutions are typically found in so-called "predator-prey" models (PPM), derived from theoretical biology. The most prominent PPM is the Lotka-Volterra model, which was already established in the 19th-century, to explain the dynamics of populations of the animal kingdom.The Lotka-Volterra equations are::

![]()

![]() (43.1)

(43.1)

Now the basic system of a national economy is of a similar structure:

Now the basic system of a national economy is of a similar structure:

![]()

![]() (43.2)

(43.2)

for the “meeting” of capital and GDP

has different effects on GDP and capital stock. In particular![]() is the result of

the encounter

is the result of

the encounter

![]() . Similarly,

however, are savings

. Similarly,

however, are savings

![]() because it

depends on an appropriate encounter

because it

depends on an appropriate encounter![]() of

the two. Thus in principle

we can

write:

of

the two. Thus in principle

we can

write:

![]()

![]() (43.4)

(43.4)

The term![]() we

have just inserted in order to demonstrate the same type of structure here. The

difference lies in the very different structure of the reproduction rates of

the two populations. The first term of the second equation, we can also replace

by net exports, which would ideally be zero, but often is not:

we

have just inserted in order to demonstrate the same type of structure here. The

difference lies in the very different structure of the reproduction rates of

the two populations. The first term of the second equation, we can also replace

by net exports, which would ideally be zero, but often is not:

![]()

![]() (43.5)

(43.5)

The different problem is

ergo, that the growth rates![]() and

and

![]() are not fed back to each other. This does not result

in a converging, but a as we will see, in divergent behavior.

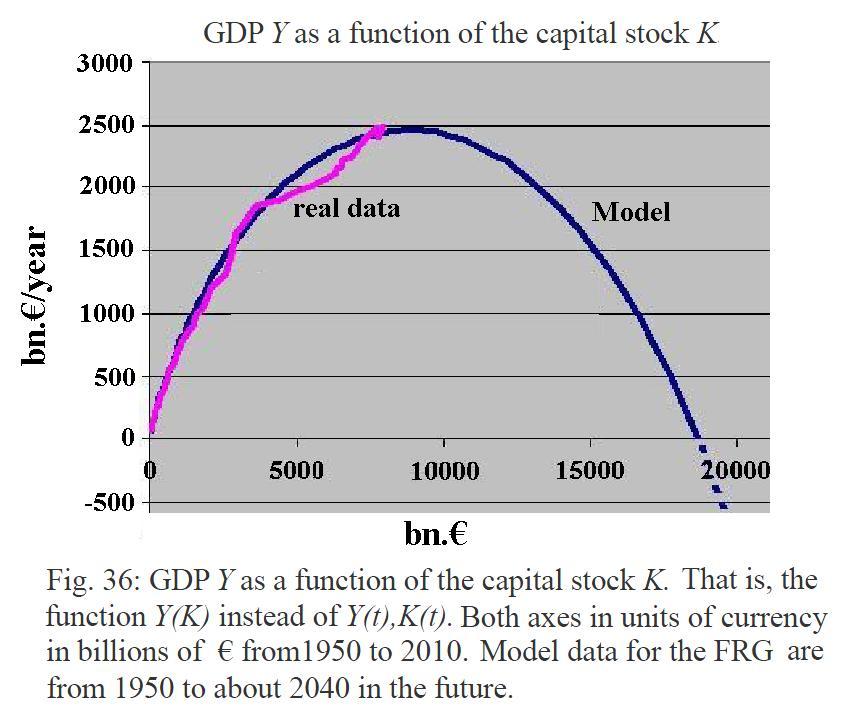

We thus want to investigate this further. Now you can also simply indicate that

GDP is a function of capital, so instead of the two functions Y(t) and K(t), we can now draw the

derived one function Y(K). So we change our reference room, to come to a

simpler but more meaningful representation. For this, we just have to plot the

real data of Y and K and the basis model data as well to show. At

first glance, this appears to be a function as a parable, and in fact they can

be approximated with a high confidence level for the FRG with the regression

are not fed back to each other. This does not result

in a converging, but a as we will see, in divergent behavior.

We thus want to investigate this further. Now you can also simply indicate that

GDP is a function of capital, so instead of the two functions Y(t) and K(t), we can now draw the

derived one function Y(K). So we change our reference room, to come to a

simpler but more meaningful representation. For this, we just have to plot the

real data of Y and K and the basis model data as well to show. At

first glance, this appears to be a function as a parable, and in fact they can

be approximated with a high confidence level for the FRG with the regression

![]() (43.6).

(43.6).

This is a practical rule of thumb to us, from which we get the GDP Y to be expected with a capital stock of K in the FRG.

The rule of thumb

![]() (43.7)

(43.7)

can be determined and used for each country N, without large external net premiums, slightly. The coefficients are sorted according to their meaning, here for the FRG:

![]() GDP-Offset

(

GDP-Offset

(![]() )

)

![]() Average

Capital Efficiency

Average

Capital Efficiency

![]() Repressional Capital Coefficient

Repressional Capital Coefficient

The constant![]() describes

in principle the GDP at the beginning of the census, compounded from

describes

in principle the GDP at the beginning of the census, compounded from![]() with inflation.

We already know the constant

with inflation.

We already know the constant![]() which is nothing

more than the average capital efficiency, which was for the FRG nearly 52%. So

in the long term one half of capital goes into the real economy, the other half

into the building up of the capital. The constant

which is nothing

more than the average capital efficiency, which was for the FRG nearly 52%. So

in the long term one half of capital goes into the real economy, the other half

into the building up of the capital. The constant

![]() now describes the negative feedback by the with

time increasing amount of return on capital as the pressure on the GDP

ultimately resulting from the compound interest. We call it, because of its low

absolute, but due to the entrance to the square of the capital increasing

weight, as the Capital Repression Coefficients

now describes the negative feedback by the with

time increasing amount of return on capital as the pressure on the GDP

ultimately resulting from the compound interest. We call it, because of its low

absolute, but due to the entrance to the square of the capital increasing

weight, as the Capital Repression Coefficients

![]() with

its unit is

with

its unit is![]() .

From the regression equation

.

From the regression equation

![]() (43.8)

(43.8)

the solution is for![]() given

by

given

by

![]() (43.9)

(43.9)

and with the values for the FRG we get![]() bn. €/year, the latter of which is the maximum

positive value of capital stock, while for the GDP to the value zero is

depressed. The maximum of the development is given by

bn. €/year, the latter of which is the maximum

positive value of capital stock, while for the GDP to the value zero is

depressed. The maximum of the development is given by

![]() at

at ![]() (43.10)

(43.10)

with ![]() Billion

€ for the FRG. This is the maximum value of the capital raising ability

of the

Federal Republic until the turn of development.

Especially the final value

Billion

€ for the FRG. This is the maximum value of the capital raising ability

of the

Federal Republic until the turn of development.

Especially the final value![]() is in the extent

of theoretical nature, as we would assume that until finite decline all market

participants would behave unaffected by the development. At the latest after

exceeding the maximum

is in the extent

of theoretical nature, as we would assume that until finite decline all market

participants would behave unaffected by the development. At the latest after

exceeding the maximum

![]() but this is

increasingly unlikely, and the artificial interventions in the monetary and

economic system are increasing. This leads to the relevant variables

but this is

increasingly unlikely, and the artificial interventions in the monetary and

economic system are increasing. This leads to the relevant variables![]() and

and![]() getting more and

more important in the basic equations .

getting more and

more important in the basic equations .