47 Rotational-Stretching-Symmetry

If we want to transfer the position vector from

the Y-K-space currently used into the usual Y,K-t-space at the

time ![]() to the time

to the time ![]() , then we can

achieve this with the help of a rotational expansion. The rotational extension

symmetry is the same symmetry, as occurs in the multiplication of imaginary

numbers:

, then we can

achieve this with the help of a rotational expansion. The rotational extension

symmetry is the same symmetry, as occurs in the multiplication of imaginary

numbers:

![]() (47.1)

(47.1)

Our position vectors are as shown above, just

![]() and

and ![]() (47.2),

(47.2),

where we have set Y in the imaginary direction, ie in general

![]() (47.3)

(47.3)

for the position vector. The expression![]() is often

associated with the function

is often

associated with the function

![]() (47.4)

(47.4)

and abbreviated. It is now apparent manner:

![]() (47.5)

(47.5)

or

![]()

![]()

![]() (47.6)

(47.6)

with the implicit Logspiral-representation

![]() . The effect of

rotation and expansion is evidently composed of inflation or Pricing

. The effect of

rotation and expansion is evidently composed of inflation or Pricing![]() and trading gain

and trading gain![]() . How true that

is easily verified

. How true that

is easily verified

![]() (47.7)

(47.7)

and

![]() (47.8).

(47.8).

We see here already that![]() moves on its own axis of GDP, while

moves on its own axis of GDP, while![]() affects

the GDP and capital axis equally. Because inflation affects both the capital

and the value of GDP both measured in money. The implicit representation

affects

the GDP and capital axis equally. Because inflation affects both the capital

and the value of GDP both measured in money. The implicit representation

![]() results in

results in ![]() and

and

![]() .

.

Inserting brings:

![]() (47.9)

(47.9)

The effect of the helical symmetry is that now enters the commercial growth in the real and imaginary parts as well.

The dynamics of economic development thus corresponds allways to a rotation and expansion, so that a change in trade is always accompanied by a price change due.

The division of two complex numbers is given by![]() , and thus can88 be written:

, and thus can88 be written:

![]()

![]()

![]()

![]()

![]() (47.10)

(47.10)

Because of![]() and

and![]() at

at![]() it follows:

it follows:

![]() (47.11)

(47.11)

and ![]() (47.12)

(47.12)

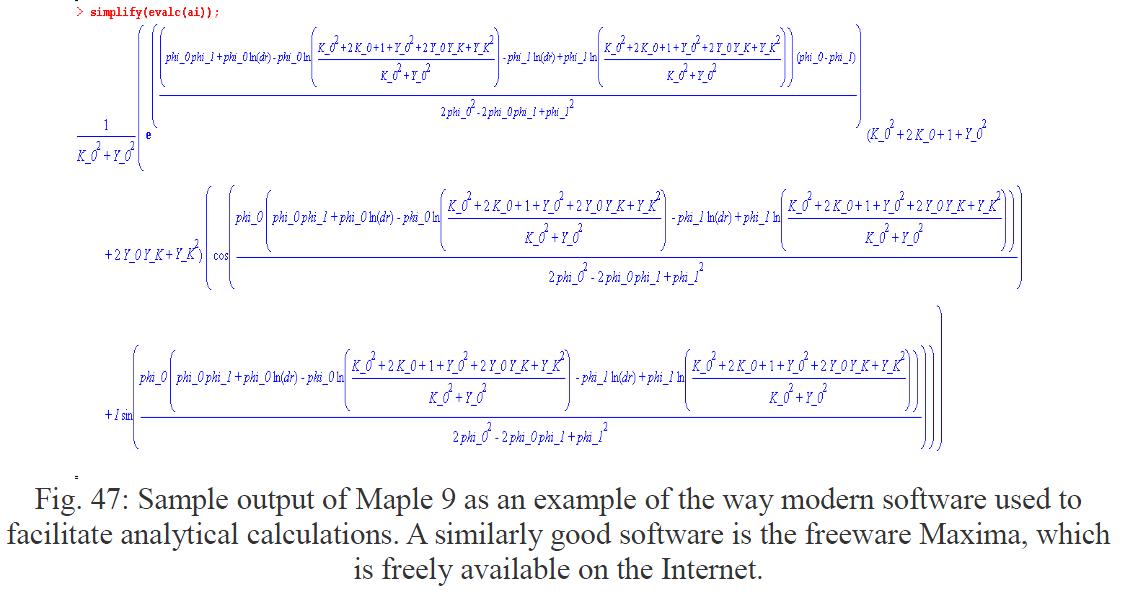

This implicit representation we have to convert

into a suitable explicit time dependence. For![]() results in the

meantime:

results in the

meantime:

![]() (47.13)

(47.13)

and further to resolve complex for![]() takes after some

merging:

takes after some

merging:

![]() (47.14)

(47.14)

with the abbreviations:

![]() ,

,![]() ,

,![]() ,

,

![]() ,

,![]() ,

,![]() and

and ![]() (47.15).

(47.15).

And in accordance with this the inflation or price-formation is

![]() (47.16).

(47.16).

Then there is the transformation back to the usual time dimension. For this we assume the mathematical relationship

![]() (47.17)

(47.17)

The angular velocity![]() we can determine

by use of the start and end time of the model economics. Because the angle was

90 degrees =

we can determine

by use of the start and end time of the model economics. Because the angle was

90 degrees =![]() at the

beginning, and 0 at the end in our vector space of Y(K)-representation.

Therefore, one may write as we start counting at

at the

beginning, and 0 at the end in our vector space of Y(K)-representation.

Therefore, one may write as we start counting at![]() :

:

![]() und

und ![]() (47.18)

(47.18)

This is![]() the

time when the GDP dropped to zero in basis theory. With

the

time when the GDP dropped to zero in basis theory. With

![]() and

and ![]() (47.19)

(47.19)

one can now determine in principle the behavior of price formation and trading volume in the usual time dimension.