7 Determination of the Net Business Rate

For the formulation of the net business rate ![]() we need a

statement about the ratio of investment into the real economy to the transactions

of the financial system to itself, that means the relation between direct and

indirect investment. Let us consider again the differential equation of

capital:

we need a

statement about the ratio of investment into the real economy to the transactions

of the financial system to itself, that means the relation between direct and

indirect investment. Let us consider again the differential equation of

capital:![]() . The coefficient

. The coefficient

![]() is the effective

interest on the capital this year. This interest stems from the two

components of direct and indirect use of capital. So we can split to:

is the effective

interest on the capital this year. This interest stems from the two

components of direct and indirect use of capital. So we can split to:

![]() (7.1)

(7.1)

Because the share of capital stock which is

sold within the financial industry immediately gains returns. The proportion

which is given initially in the real economy reduces the capital stock this

year and receives its return later, presumable next year. The interest rates ![]() however can also

be different. With the simple substitutio

however can also

be different. With the simple substitutio![]() we

get now:

we

get now:

![]() (7.2)

(7.2)

So we have to carry two blocks from the income and expenditure which is the overall result. But we can summarize this flat in one rate by

![]() (7.3)

(7.3)

defined as the difference between the results

of expenditure and revenue. With ![]() then

as the average nominal interest rate on all types of assets. And the proportion

who fail this year due to the credit of it is

then

as the average nominal interest rate on all types of assets. And the proportion

who fail this year due to the credit of it is ![]() .

This approach simplifies calculations thereafter significantly. Next we define

the relative value

.

This approach simplifies calculations thereafter significantly. Next we define

the relative value ![]() as the share

which represents the direct use of capital to total capital stock:

as the share

which represents the direct use of capital to total capital stock:

![]() (7.4)

(7.4)

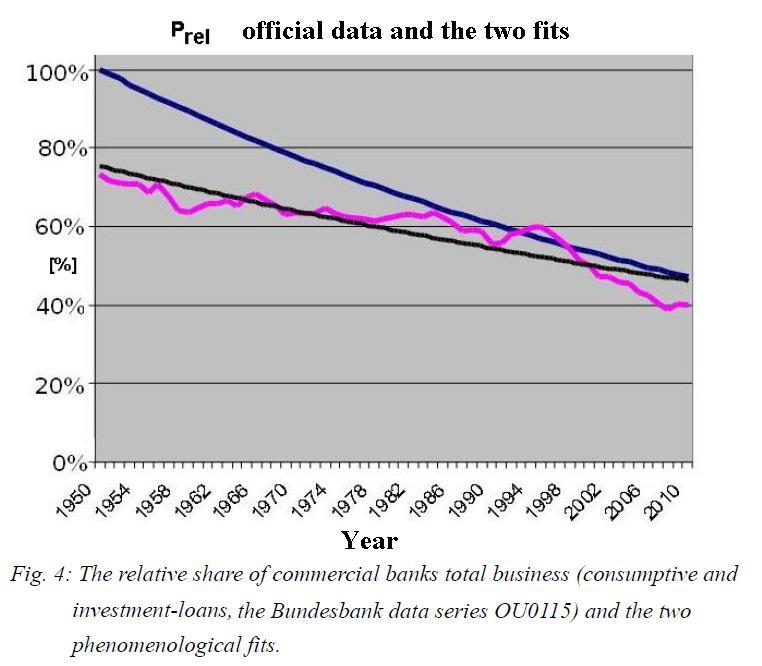

This value was in 1950, two years after the introduction of the German mark, according to figures from the Bundesbank14 at about 73% and decreased continuously to less than 40% in 2010. This can be phenomenologically explained by the fact that at the beginning15 of an economy the capital is available to virtually all loans (investment and consumptive) as flows into the real economy. With increasing time and thus increasing capital stock, more and more money goes into the banks own business (the "Investment Banking"), as the yield-oriented investments get more and more scarce in the real economy over time.

Since we now have to specify the relative

proportion not absolute, but as a percentage of total interest income in our

equation, we write this value to something different: ![]() is the share of

interest income

is the share of

interest income ![]() that comes from

lending into the real economy as an absolute part of a percentage. Thus applies

to the net business ratio16

that comes from

lending into the real economy as an absolute part of a percentage. Thus applies

to the net business ratio16 ![]() after

the reinvestment of

after

the reinvestment of ![]() to the GDP now in

terms of

to the GDP now in

terms of![]() as:

as:

![]() (7.5)

(7.5)

If we look at the real data of![]() (Fig. 4), then we

see its regular course. We can start with a simple phenomenological17 approximation, namely that the

share of reinvestment decreases slowly according to a simple exponential form:

(Fig. 4), then we

see its regular course. We can start with a simple phenomenological17 approximation, namely that the

share of reinvestment decreases slowly according to a simple exponential form:

![]() (7.6)

(7.6)

As is easily seen, this function starts (![]() ) with the value

) with the value ![]() . After the

exponential half-lifetime18

. After the

exponential half-lifetime18![]() it falls off to

it falls off to ![]() and then very

slowly goes towards zero. Our formula is therefore justified phenomenologically

as

and then very

slowly goes towards zero. Our formula is therefore justified phenomenologically

as

![]() (7.7)

with

(7.7)

with

![]() average nominal

interest rate over all assets

average nominal

interest rate over all assets

![]() Initial direct

capital investment as a share of total capital stock

Initial direct

capital investment as a share of total capital stock

![]() The period after the direct capital investment has dropped to about 1/e=36.7%

(exponential half-lifetime). In order to eliminate the specific initial

parameter

The period after the direct capital investment has dropped to about 1/e=36.7%

(exponential half-lifetime). In order to eliminate the specific initial

parameter ![]() and in the

interest of generality and a purely phenomenological analytical consideration,

it can be assumed that at the beginning of an economy almost 100% of the

capital is used for the loans to finance the real economy (upper fit curve).

and in the

interest of generality and a purely phenomenological analytical consideration,

it can be assumed that at the beginning of an economy almost 100% of the

capital is used for the loans to finance the real economy (upper fit curve).